Personal Finance and Financial Basics - Fidelity Investments Can Be Fun For Everyone

Money Monday: Personal finance tips for the new year

Money Monday: Personal finance tips for the new year 7 Most Useful Personal Finance Tips & Tricks - Invisibly Me

7 Most Useful Personal Finance Tips & Tricks - Invisibly MeThe Greatest Guide To Financial Literacy 101's Personal Finance Guide

Get your free quote here. There are a lot of strong financial suggestions on this list. Don't get overloaded, take a deep breath, and work at your own pace! It may seem complicated, but the product is much simple when you set a rate. Don't hurry the process, your finances will thank you.

109 Personal Finance Tips : Things You Should Have Learned in High School, Pa 9781981227006 - eBay

109 Personal Finance Tips : Things You Should Have Learned in High School, Pa 9781981227006 - eBayYou don't require a higher-paying job or a windfall from a relative to enhance your personal finances. For many individuals, better cash management is all it requires to decrease their spending, enhance their ability to invest and conserve, and achieve financial goals that when seemed difficult. Even if you feel like your financial resources are stuck in a bad place with no escape, there are a number of things you can do to develop a much better situation for yourself.

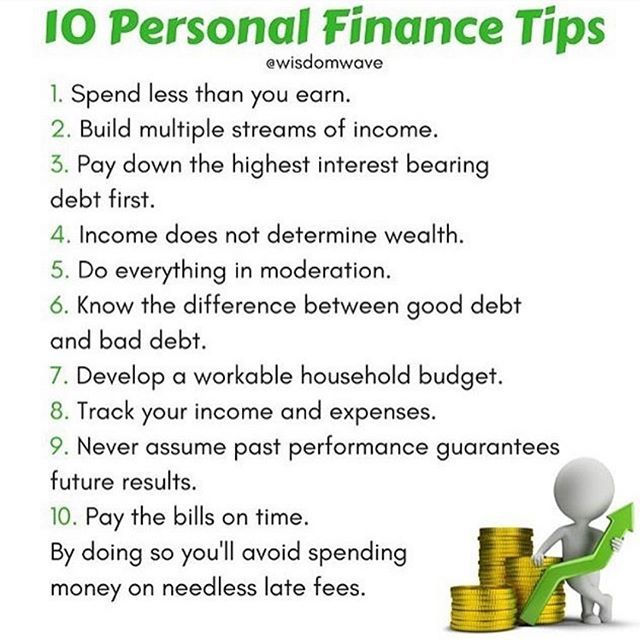

1. Track your spending to enhance your financial resources. If you don't know what and where you're investing monthly, there's a likelihood your personal spending routines have space for improvement. Much better finance starts with costs awareness. Utilize a finance app like Cash, Track to track costs throughout classifications, and see on your own how much you're spending on non-essentials such as dining, home entertainment, and even that daily coffee.

2. Produce a reasonable monthly budget plan. Utilize your month-to-month spending habits, in addition to your monthly take-home income, to set a spending plan you understand you can keep. There's no use setting a stringent budget plan based on extreme changes, such as never ever eating in restaurants when you're currently buying takeout four times a week.

Top Guidelines Of 15 Financial Tips And Tricks From Graham Stephan - BuzzFeed

You need to see a budget plan as a method to motivate better habits, such as cooking at home more frequently, but provide yourself a sensible chance at conference this budget. Look At This Piece 's the only method this finance approach will work. 3. Construct up your savingseven if it takes time. Create an emergency situation fund that you can dip into when unpredicted situations strike.

You should likewise make basic cost savings contributions to strengthen your monetary security in case of a job loss. Use automated contributions such as FSCB's pocket modification to grow this fund and enhance the routine of putting away cash. 4. Pay your expenses on time every month. Paying expenses on time is a simple way to manage your money sensibly, and it comes with excellent advantages: It assists you avoid late costs and focuses on necessary spending.