8 Easy Facts About Purchase Order Financing - SouthStar Capital Explained

How Does Purchase Order Financing Work? - Convertibill®

How Does Purchase Order Financing Work? - Convertibill®All about Purchase Order Finance - Tip Top Capital

While it's easy to get approved for these sort of loans and the application procedure isn't cumbersome, they typically feature significantly high rate of interest. In case your company goes under, you'll be accountable to pay back the lender, plus interest. can likewise assist fund your organization. You just need to be prepared to provide up equity or handle debt.

Purchase Order Financing and PO Funding - Improve Cash Flow

Purchase Order Financing and PO Funding - Improve Cash FlowYou may, however, have to provide up some control of your operations. If you pick to sell equity, you'll also need to prepare to take house a smaller piece of the pie as you'll need to share profits with other owners. can be used to fund small companies on a momentary basis.

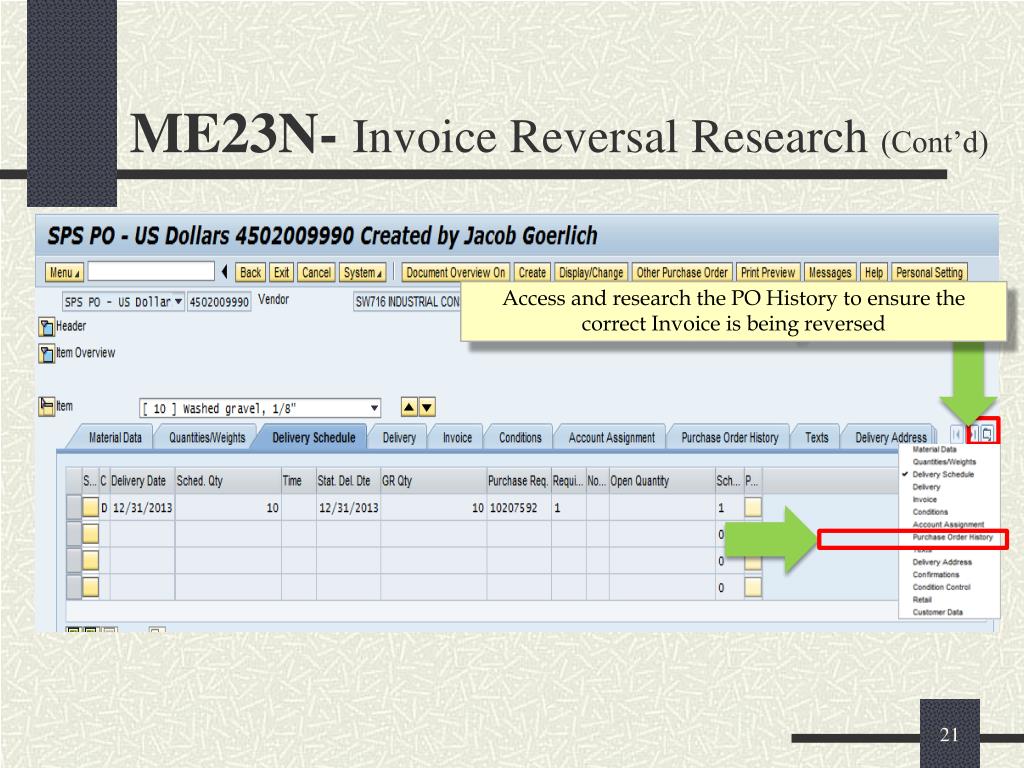

Purchase Order Financing - ppt download

Purchase Order Financing - ppt downloadService lines of credit might likewise cause additional monetary difficulties in case business doesn't go as you hope it will. If you max out your line of credit and aren't producing the earnings required to pay it back, you may need to take on yet another loan just to settle your account.

We're here to help. today so that you can dominate any cash flow issues your small company may deal with tomorrow.

Purchase Order Financing - Gateway Trade Funding Things To Know Before You Get This

When you take on a routine service loan, you generally need to sign a individual warranty. This means that if business can't repay the loan, the lender can seize your individual properties to get their refund. PO funding is normally non-recourse. This means if your customer is not able to pay for the items, the lender soaks up the danger.

Whether the consumer declines the delivery of goods, is disappointed with the product, goes broke after the delivery, or for any other reason doesn't pay, the lending institution loses their money. Naturally, you must talk to the loan provider about their policies in case the client does not pay.

850 Jetty Lane, Chula Vista, CA 91914.

What is Purchase Order Financing? Full Article is fast, short-term funding used to fund items supplied by a third-party maker or supplier to meet confirmed order from a company's clients. It is often used by business that do not have enough capital to buy stock to finish brand-new or large orders they want to handle to grow.

Not known Factual Statements About The difference between purchase order financing and invoice

In many cases, an accounts receivable lender will advance profits as soon as the consumer is invoiced and pay the purchase order financing business directly.