An Unbiased View of Oil futures trade below $30 a barrel for first time since 2003

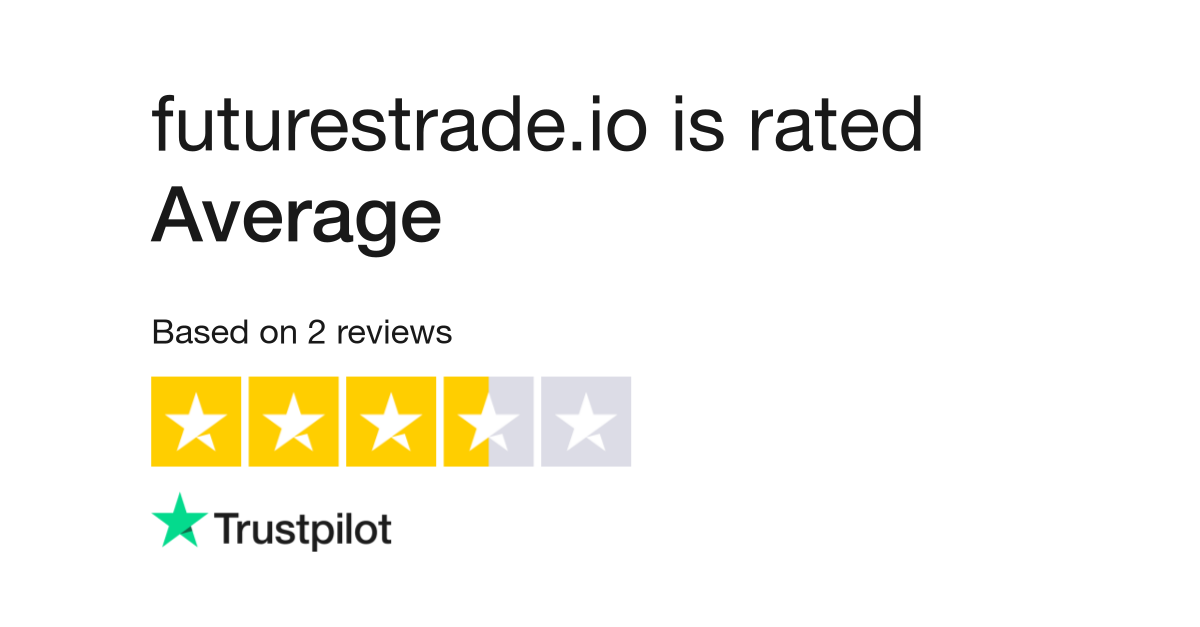

The Only Guide for futurestrade.io review

The 2 primary strategies are: Cash-and-Carry Futures Arbitrage Inter-exchange Premium Arbitrage Cash and Carry Premium Arbitrage The Cash-and-Carry futures trading method is the most popular in the market for numerous factors. Mostly, its popularity stems from its market neutral method. If done correctly, the cash-and-carry technique minimizes danger exposure for the investor.

The primary objective of this strategy is to make use of prices inadequacies in the area price Fundamentals of Cash-and-Carry-Arbitrage The primary step in a standard cash-and-carry-arbitrage is to examine the market. You will need to closely keep track of the portion distinction in between the current spot cost of Bitcoin and the price of Bitcoin Futures contracts.

The smart Trick of Full article: Bitcoin futures: trade it or ban it? - Taylor & Francis That Nobody is Talking About

This data will enable you to compile a better awareness of how the 2 cost points associate. Next, a Bitcoin Futures arbitrageur would make two purchases. The first purchase would be a long position in Bitcoin. Notably, this is a direct investment into Bitcoin. The financier would then open a short Bitcoin futures contract at the very same time and for the very same quantity.

Tron24 Review - Is tron24.io a Cloud Mining Scam?

Tron24 Review - Is tron24.io a Cloud Mining Scam?Volatility In many circumstances, you will discover the futures agreements experience more extreme price volatility than Bitcoin directly. They likewise trade for a much greater worth normally. However, there are instances where the Futures fall listed below the area rate too. You will require to use your chart to identify when the Futures rate uncouples from the area rate.

The 7-Second Trick For Futurestrade.io HYIP ReviewScam or Legit? Full Statistics

The difference in between Bitcoin's current spot cost and the cost of the futures contract is the profit. This opportunity is present whenever the inflow from the brief futures position surpasses the acquisition cost and bring costs on the long possession position. Not Full Evidence It holds true that the cash-and-carry method does restrict threat in particular market conditions.

India's curb on futures trade threatens food supply chain

India's curb on futures trade threatens food supply chainAcutely, you will wish to monitor your charges and other factors such as margin expenses. All of these can accumulate and chip away at your earnings in time. Inter-Exchange Premium Arbitrage In the inter-exchange investment strategy, you are looking for to earn a profit off of the irregularity in futures costs from one platform to another.

How to Place a Futures Trade : tastyworks

How to Place a Futures Trade : tastyworksHow Latest News & Videos, Photos about futures trade - The can Save You Time, Stress, and Money.

The simplest kind is to discover Bitcoin futures rate gaps in between platforms and trade your asset in between each to earn the earnings. While this may sound simplified, there are some extra dangers to avoid. Reference of the very first things you wish to examine is the trading pairs used by the platforms.