Everything about Working at Bankruptcy Discharge Papers - Glassdoor

Form B 9I Chapter 13 Case (12/11)

Form B 9I Chapter 13 Case (12/11)Our I need confirmation my bankruptcy has ended - Australian Statements

Although a chapter 13 debtor typically receives a discharge only after completing all payments required by the court-approved (i. e., "validated") payment plan, there are some restricted scenarios under which the debtor might ask for the court to approve a "hardship discharge" although the debtor has actually failed to complete plan payments.

The scope of a chapter 13 "hardship discharge" resembles that in a chapter 7 case with regard to the kinds of debts that are excepted from the discharge. A challenge discharge likewise is offered in chapter 12 if the failure to finish plan payments is due to "circumstances for which the debtor need to not justly be held accountable." Does the debtor deserve to a discharge or can creditors challenge the discharge? In chapter 7 cases, the debtor does not have an outright right to a discharge.

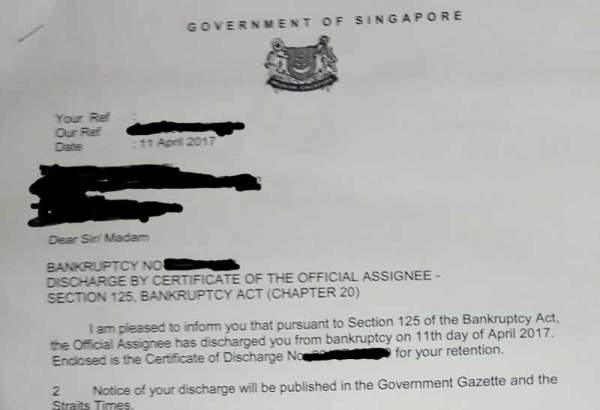

How do bankruptcy discharge paper look like? - video Dailymotion

How do bankruptcy discharge paper look like? - video Dailymotiontrustee. This Is Cool receive a notice quickly after the case is submitted that sets forth much crucial details, including the due date for objecting to the discharge. To challenge the debtor's discharge, a creditor needs to submit a complaint in the personal bankruptcy court prior to the due date set out in the notification. Filing a complaint starts a lawsuit described in personal bankruptcy as an "foe proceeding." The court might reject a chapter 7 discharge for any of the reasons explained in section 727( a) of the Bankruptcy Code, including failure to supply requested tax files; failure to finish a course on personal financial management; transfer or concealment of residential or commercial property with intent to hinder, delay, or defraud creditors; destruction or concealment of books or records; perjury and other deceptive acts; failure to account for the loss of possessions; offense of a court order or an earlier discharge in an earlier case started within specific time frames (gone over listed below) prior to the date the petition was submitted.

Top Guidelines Of Bankruptcy - Shelby County Trustee, TN - Official Website

In chapter 12 and chapter 13 cases, the debtor is usually entitled to a discharge upon conclusion of all payments under the strategy. As in chapter 7, however, discharge might not take place in chapter 13 if the debtor fails to complete a needed course on personal monetary management. A debtor is also disqualified for a discharge in chapter 13 if she or he received a previous discharge in another case began within time frames went over the next paragraph.