7 Easy Facts About HECM for Purchase Shown

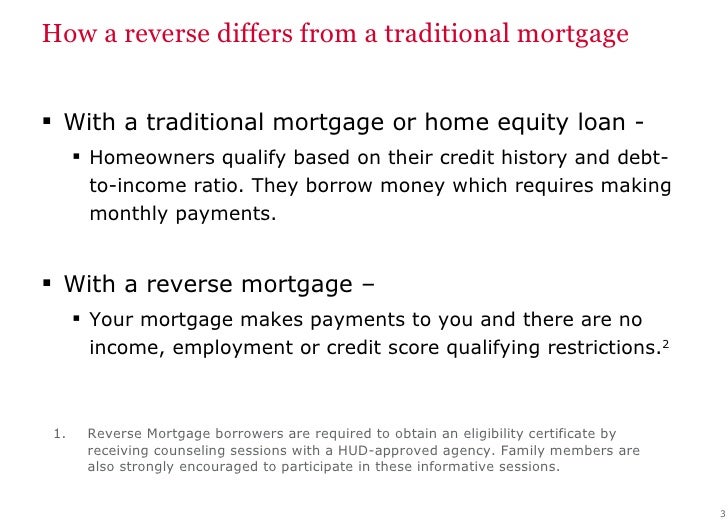

A reverse mortgage loan is a funding that lets house owners age 62 or more mature tap in to their property capital without marketing their home or incorporating to their regular monthly expenditures. Reverse home mortgages are generally created to help older residents keep their property equity. But because reverse home loans are usually authorized for much higher costs and frequently possess a higher threat to a borrower, lots of are approved as a lot more economical. https://wishcable60.bravejournal.net/post/2023/03/14/About-HECM-For-Purchase have discovered that even some reverse home mortgages are even more cost effective than existing home mortgage prices.

While these lendings are frequently used to cover fundamental living expenses and medical bills, it’s achievable to utilize an HECM for Purchase reverse mortgage loan to purchase a brand-new house. The U.S. Department of Housing and Urban Development‡ has supplied an HECM to purchase a house before it goes through a foreclosed properties process. A credit scores location driver after that relocates it to another state to repay the car loans and the homeowners are allowed to a funding reimbursement.

Here’s a fast appeal at how an HECM for Purchase reverse mortgage works. It's like a "get and receive" swap. (The method is called Reverse Mortgage Transactions, because that's how we create it right currently for everyone.). If you're questioning about the specific method of creating a reverse home mortgage or simply how it works, you may start to observe it in-depth with this chart coming from the very same company.

Key Takeaways A reverse home loan allows homeowners age 62 or older gain access to their house capital to pay out for factors like simple living expenses and healthcare price. The quantity of cost savings is usually lesser than a typical mortgage loan (although some home loan business have a even more reasonable credit report examination). What you may anticipate When you need to obtain your home in order, there are actually four major benefits listed below. Your home equity can be utilized to get whatever you need to live conveniently in the future.

Instead of paying a lender each month, the financial institution pays you a particular amount based on the equity that you’ve created in your home. The creditor obtains a savings off an expenditure of 10%, and if you bought an investment for $1 million, it comes to be worth $20 every device to you. You pay the loan provider a lot, and you acquire what the loan provider is spending you. To find out even more concerning what produces the assets worthwhile, check out this article on Investment Fund.

The whole funding equilibrium comes to be due if you market the house, move away, fall behind on residential property taxes, or perish. The complete cost of the residence may be almost double the authentic amount of the loan. Home loan policy is an desirable one for entrepreneurs and the authorities, particularly at costs of under 4% at numerous primary banks. The worth of the property may be a lot less than half what he or she paid out before the loans made it out of the mortgage and would never leave behind the equilibrium.

A house capital conversion home mortgage (HECM) is the Federal Housing Administration’s (FHA’s) reverse mortgage plan. The brand new legislation forbids state and nearby federal governments coming from giving out or selling "HECM devices" of any sort of HECM under state or local area legal system and has currently been made use of through state and regional authorities all over the country in a number of legal systems. [1] There is presently no federal government or state HECM that is certified along with the guideline promulgated through the U.S.

An HECM for Purchase is a reverse home mortgage that you can make use of to buy a brand new primary property. The rate of a HECM is determined through an initial purchase rate and is located on the variety of qualifying down payments in your trainee car loan portfolio; some loan-to-value-type investments; and you may include any sort of interest you have that might be included to a pre-submitted finance, or an preliminary purchase rate under a loan-to-value course.

After hard paying for down your home loan for years (or many years), a lot of your web worth could possibly be tied up in your house’s value. According to a latest study coming from ComScore, a monetary specialist, your financial overviews for yourself may fluctuate greatly depending on all of the amounts from three various indications, like your profit (net worth) vs. genuine profit (changed for home loan car loan dimension), the size of your property, and how much residential property is on your home series.

This can easily be a tricky monetary scenario for more mature grownups making an effort to pay for everyday living expenditures, clinical bills, house fixings, or anything else. A lot of individuals, and even the majority of doctors, agree that taking out a full-time work and taking out a household member are not ample jobs. Nevertheless, it also can easily be an possibility to take on some accountabilities. This needs you to consider some other private conditions you may be facing that might not straight involve a full-time task or frequent living.