The 9-Minute Rule for How Do You Get a Business Tax ID Number? - TurboTax

W-9 instructions

W-9 instructionsThe 6-Second Trick For Get federal and state tax ID numbers - SBA

There are 5 kinds of TIN numbers: Social Security Number Employer Identification Number Individual Taxpayer Recognition Number. This is for specific taxpayers who are disqualified for an SSN, such as some homeowners or undocumented immigrants. Find More Details On This Page . This number is for Pending U.S. Adoptions Preparer Taxpayer Identification Number. This is for accounting professionals who submit taxes on behalf of others.

4 Ways to Find a Federal Tax ID Number - wikiHow

4 Ways to Find a Federal Tax ID Number - wikiHowThe major thing US-based organizations with US-citizen owners require to comprehend is the difference between an EIN & an SSN and who needs which number. So who needs an EIN? In basic, an EIN is essential for organizations that either employ other individuals, have a multi-ownership structure (such as is the case with a partnership, corporation, or LLC), or those that are making a significant modification to their structure.

The exact same holds true with a single-member LLC. Nevertheless, some sole owners choose to get an EIN number anyhow to protect their identity. But if there are 2 people tied to a single service entity, then business is considered to have its own tax problems. In this case, an EIN is required.

What Does What is an EIN? - Harbor Compliance Mean?

In case the owner or legal details requires to alter, you will have to submit the correct paperwork to update/change your EIN. For multi-member organizations such as a corporation or LLC, there is no limit to the number of EINs you can have. Whether you need more than one EIN will depend upon how your organization operates.

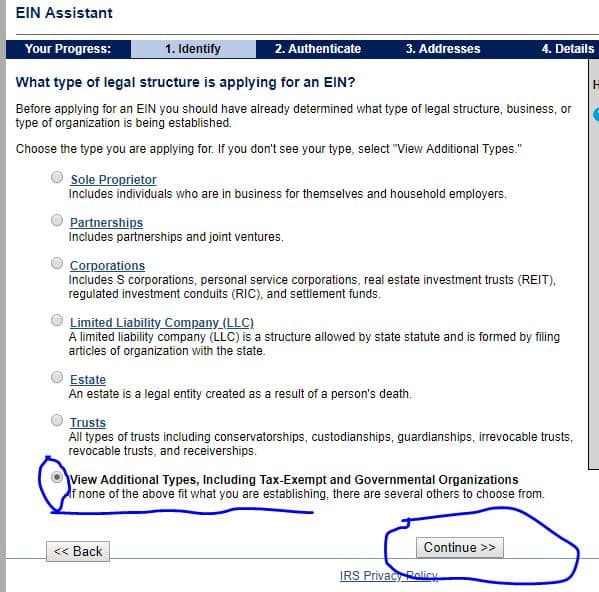

However if you choose to silo off departments into their own service entities for tax purposes, you can apply for a brand-new EIN number for each of those departments (as they are now separate tax entities). You might likewise select to take this path for numerous areas. How to Get an EIN Number Getting an EIN must happen after you have actually formed your service as a legal entity and gotten a designated company legal name.

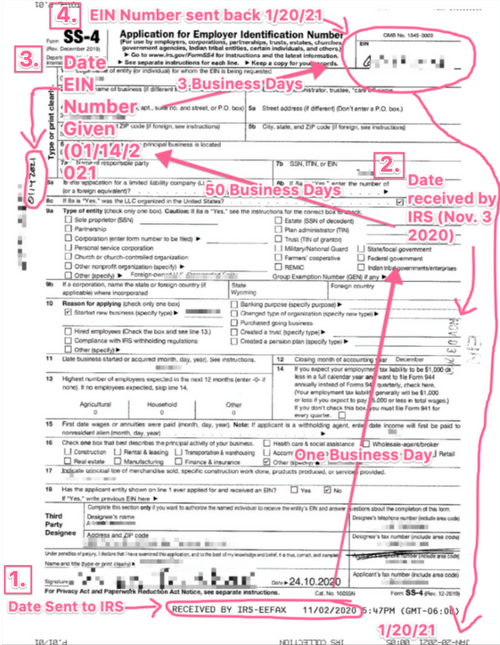

To get an EIN number, You will need to get it on the internal revenue service site. The application is totally free and you can get your EIN instantly. Just how much does it cost to get an EIN? The application, processing, and distribution of EIN numbers are entirely complimentary. How long does it require to get an EIN number? So, for how long does it require to get an EIN? For the most part, an EIN can be issued instantly.