The Buzz on The Swap - International Swaps and Derivatives Association

The Only Guide to State Wildlife Action Plans (SWAP): Home - USGS.gov

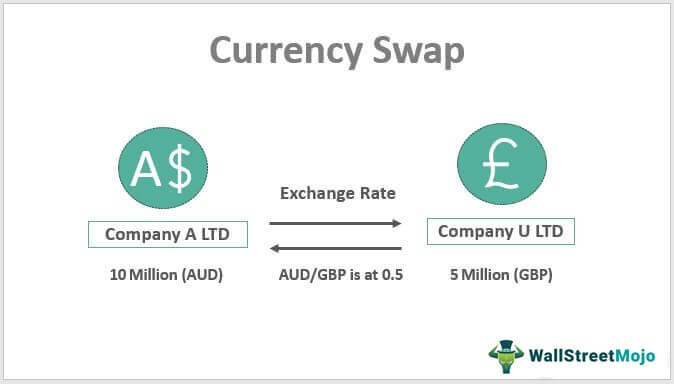

e. very same notional amount and fixed-for-floating, and so on. The swap agreement for that reason, can be seen as a series of forward contracts. In the end there are 2 streams of cash flows, one from the celebration who is constantly paying a fixed interest on the notional amount, the set leg of the swap, the other from the party who accepted pay the drifting rate, the drifting leg.

History [edit] Swaps were first presented to the general public in 1981 when IBM and the World Bank participated in a swap contract. Today, swaps are amongst the most greatly traded monetary agreements worldwide: the total quantity of rates of interest and currency swaps outstanding was more than $348 trillion in 2010, according to Bank for International Settlements (BIS).

The Dodd-Frank Act in 2010, nevertheless, pictures a multilateral platform for swap quoting, the swaps execution facility (SEF), and requireds that swaps be reported to and cleared through exchanges or clearing houses which consequently led to the formation of swap information repositories (SDRs), a main facility for swap data reporting and recordkeeping.

futures market, and the Chicago Board Options Exchange, registered to end up being SDRs. They started to list some kinds of swaps, swaptions and swap futures on their platforms. Other exchanges followed, such as the Intercontinental, Exchange and Frankfurt-based Eurex AG. According to the 2018 SEF Market Share Stats Bloomberg controls the credit rate market with 80% share, TP controls the FX dealership to dealership market (46% share), Reuters dominates the FX dealer to client market (50% share), Tradeweb is strongest in the vanilla rate of interest market (38% share), TP the most significant platform in the basis swap market (53% share), BGC dominates both the swaption and XCS markets, Tradition is the most significant platform for Caps and Floors (55% share).

DappRadar Hub

DappRadar Hub What is a Sim Swap? Definition and Related FAQs - Yubico

What is a Sim Swap? Definition and Related FAQs - YubicoWhat Does City of Omaha scraps plan to swap police gear with '88 Tactical' Mean?

At the end of 2006, this was USD 415. 2 trillion, more than 8. 5 times the 2006 gross world product. However, given that You Can Try This Source generated by a swap amounts to an interest rate times that notional quantity, the money flow generated from swaps is a considerable portion of however much less than the gross world productwhich is likewise a cash-flow step.