Some Known Factual Statements About Swap - definition of swap by The Free Dictionary

Explore the World For Yourself

Explore the World For Yourself Explore the World For Yourself

Explore the World For YourselfAn Unbiased View of ShibaSwap: HOME

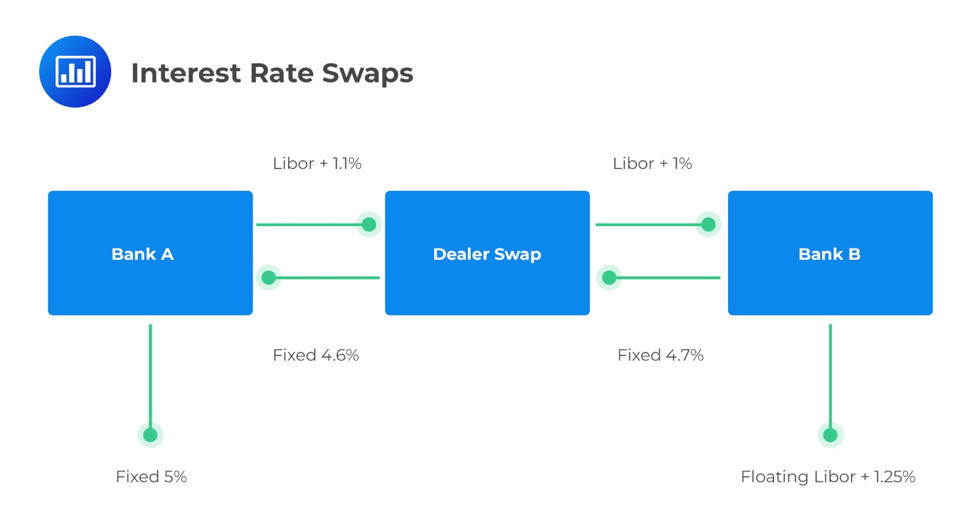

Interest rate swaps [modify] A is currently paying drifting, but wishes to pay fixed. Additional Info is presently paying fixed but wishes to pay drifting. By participating in a rate of interest swap, the net result is that each party can 'swap' their existing obligation for their wanted commitment. Generally, the celebrations do not swap payments straight, but rather each sets up a different swap with a financial intermediary such as a bank.

Swap price today, XWP to USD live, marketcap and chart - CoinMarketCap

Swap price today, XWP to USD live, marketcap and chart - CoinMarketCapThe most typical type of swap is an interest rate swap. Some companies might have comparative advantage in fixed rate markets, while other business have a comparative benefit in floating rate markets. When companies wish to obtain, they look for low-cost borrowing, i. e. from the market where they have comparative benefit.

Some Ideas on Swap.com - Your Affordable Thrift and Consignment Store You Should Know

This is where a swap can be found in. A swap has the effect of changing a fixed rate loan into a drifting rate loan or vice versa. For example, celebration B makes routine interest payments to celebration A based upon a variable interest rate of LIBOR +70 basis points. Celebration A in return makes periodic interest payments based upon a fixed rate of 8.

The payments are computed over the notional amount. The very first rate is called variable due to the fact that it is reset at the start of each interest estimation duration to the then current referral rate, such as LIBOR. In truth, the actual rate received by A and B is a little lower due to a bank taking a spread.

The Definitive Guide for What are currency swap lines? - European Central Bank

The principal is not exchanged. The swap effectively limits the interest-rate danger as an outcome of having varying loaning and interest rate. Currency swaps [modify] A currency swap includes exchanging primary and set rate interest payments on a loan in one currency for principal and fixed rate interest payments on an equivalent loan in another currency.