Our Top Bitcoin Buying and Selling Tips - Paxful Blog Ideas

.png) The day of the week effect in the cryptocurrency market - ScienceDirect

The day of the week effect in the cryptocurrency market - ScienceDirectThe Ultimate Guide To Cryptocurrency: When Is the Right Time to Buy? - The Motley

Additionally, there will be people who will sell their holdings at a loss when the crypto currency undergoes a rate correction. With all of that in mind, you need to stay firm while trading Bitcoin and be prepared to see its value fluctuate typically. If you do wish to offer Bitcoin, then ensure that you are going to get the very best exchange rate possible.

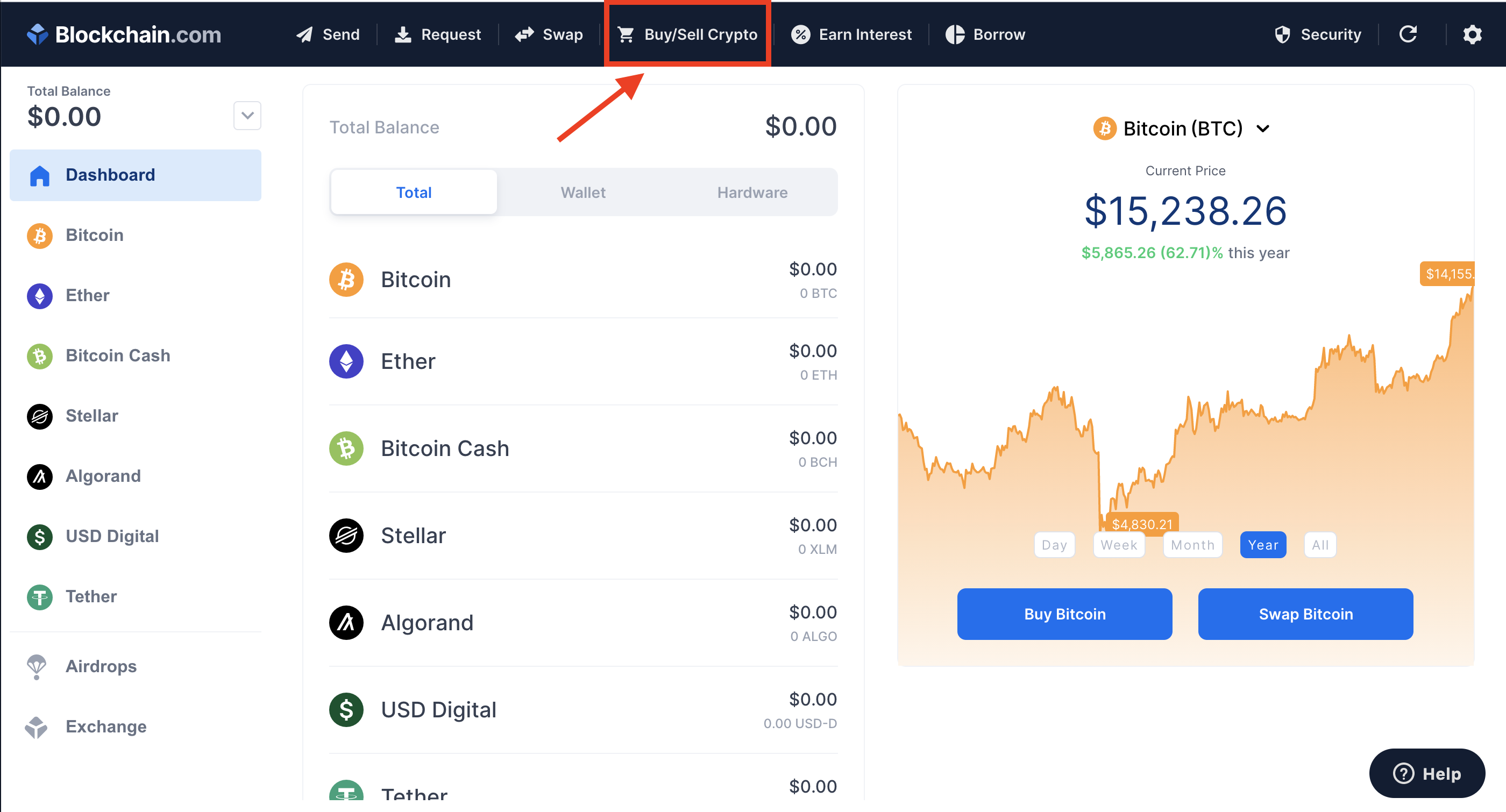

Best Time Of Day To Buy Cryptocurrency - What Time Is Best To Buy Bitcoin?

Best Time Of Day To Buy Cryptocurrency - What Time Is Best To Buy Bitcoin?Ironically, the charges in most exchanges are high. Exit based upon personal targets A lot of financiers will certainly have a target cost in mind. when is the best time to sell bitcoin might be associated with technical, fundamentals or even based on general viewpoint in social networks platforms. In addition, individual needs or plans may also make an investor think that a specific price would suffice to achieve short-term or medium-term goals.

What's the best day of the week to buy or sell Bitcoin? — Steemit

What's the best day of the week to buy or sell Bitcoin? — SteemitAnother might not be pleased even with 20x returns. Almost a majority of crypto investors fall in this classification. Most of the times, any of the 2 scenarios are possible after they sell their holdings. Hold Bitcoin and see it plunge from $13,000 to $3000. Sell Bitcoin and see it rally to over $20,000 quickly.

How Cryptocurrency: When Is the Right Time to Buy? - The Motley can Save You Time, Stress, and Money.

Given the windfall gain, there is a middle choice available to such crypto financiers. When the value of Bitcoin strikes 4-6 times the investment, attempt unloading 20% to 30% of holdings. If the crypto declines sharply then there will not be any regret. If it rises even more, still, the investor can view the rally without any guilty feeling.

The system likewise balances potential gains from possible losses. Exit based upon technical indicators Expert traders mainly choose a mix of technical and essential factors, in addition to total market belief to decide an entry or exit from a trade. While there are almost 1000s of technical signs, the most popular ones amongst knowledgeable traders are, Relative strength index (RSI), Moving Average Merging Divergence (MACD) and momentum.

Traders also utilize either or both 50-day and 200-day moving average to rapidly comprehend the overall rate trend. When the short-term moving average (50-day) crosses above the long-lasting (200-day) moving average, it is construed as a buy signal, and vice versa. So, a Bitcoin trader should continue to hold without in spite of the volatility.