The Partnership 401(k) Contributions and More Tax-Favored Ideas

IRS Announces Higher 2020 Retirement Plan Contribution Limits For 401(k)s And More

IRS Announces Higher 2020 Retirement Plan Contribution Limits For 401(k)s And MoreSome Known Facts About Self-Employed 401(k) Contributions Calculator - AARP.

For more information about the December 31, 2021 plan adoption/establishment deadline check out. self employee 401k will require to establish account by end of year, fix? If you are self-employed and open a by December 31, 2021, you will be able to wait till next year (2022) to contribute $58,000 plus an extra $6,500 if you turn 50 in 2021 or are already over age 50.

For 2022 I intend on earning money through an LLC, does this have an impact on my solo 401k if developed this year in 2021? For 2021 I am an independent contractor with no LLC or corp set up. You can still setup the solo 401k in 2021 under your sole owner organization.

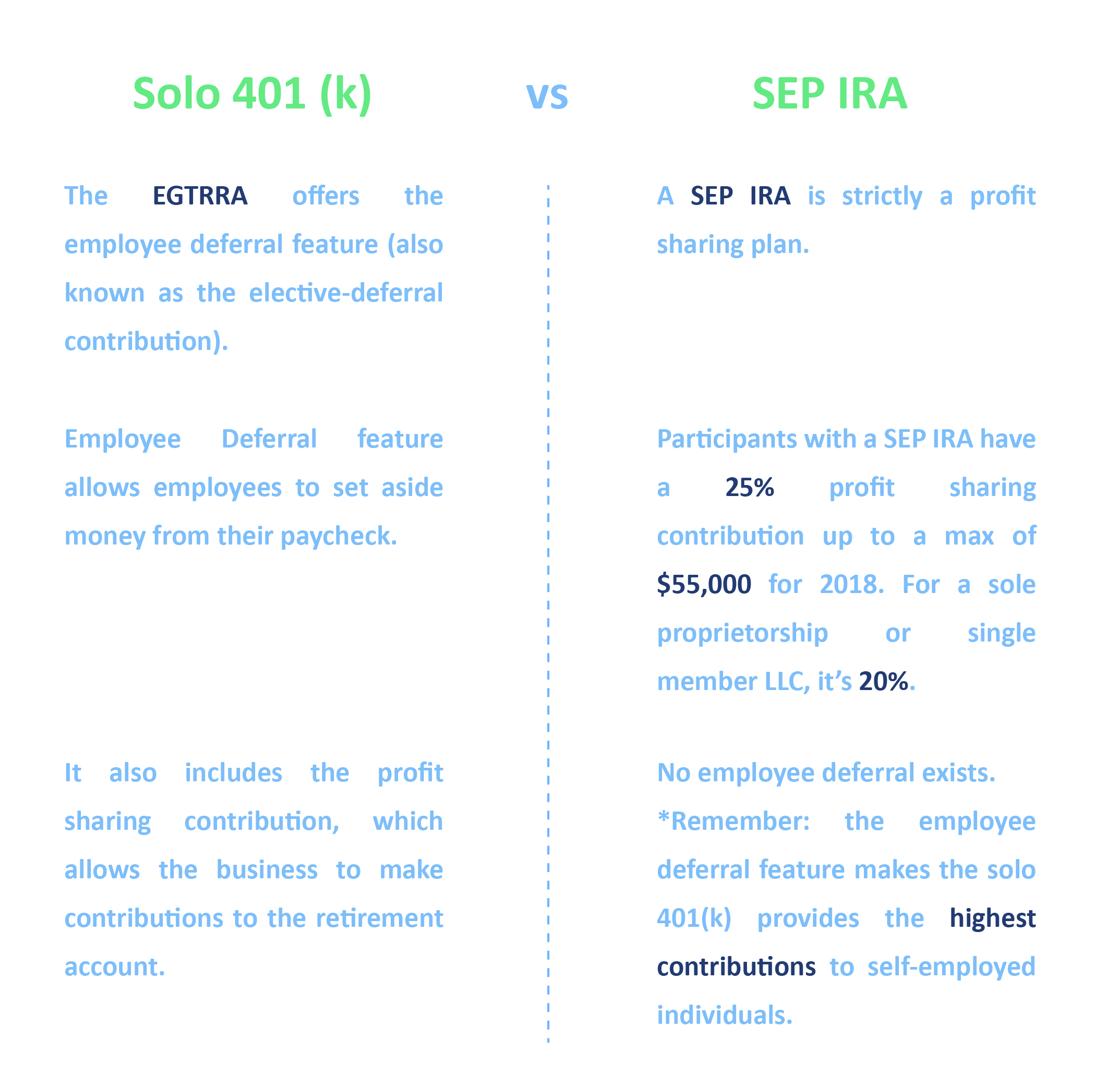

A Biased View of Benefits of a Solo 401(k) for the Self-Employed - Investopedia

All else would remain the exact same (e. g., exact same plan name, exact same checking account for the solo 401k, and so on). The 2022 annual solo 401k contributions would be based on your new self-employment income and you would have until 2023 to make those contributions.: Does that mean that for 2021 my wife and I could EACH contribute approximately $116k in Type 2 contributions into our respective Solo 401k strategies (so $58k * 2 = $116k of max contributions).

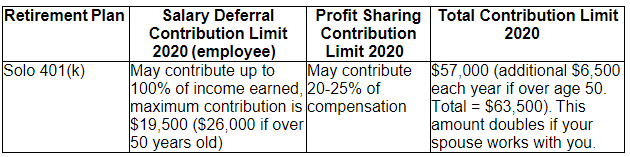

:strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif) Retirement Contribution Limits for 2020 - Navalign

Retirement Contribution Limits for 2020 - NavalignFor example, if the self-employed service is an LLC that is taxed as as sole proprietorship, both partners will require to file a different Set up C and their solo 401k contributions will be based on their respective Arrange C net self-employment earnings figure, so line 31 of the Arrange C.: Does my wife need to be paid a wage from business prior to business can make a Type 2 contribution on her behalf? Good concern and the answer is yes.

2020 Solo 401k Contributions-Pretax, Roth & Voluntary After Tax - My Solo 401k Financial

2020 Solo 401k Contributions-Pretax, Roth & Voluntary After Tax - My Solo 401k FinancialThe IRS Increases 2021 Contribution Limits to SEP IRAs and Can Be Fun For Everyone

However, you are right that employee contributions (Type 1) are capped at $19,500 for tax year 2021 (plus a $6,500 catch-up if age 50 or older) in between all 401k strategies. For that reason, if your other half has currently maxed out the $19,500 employee contribution (Type 1) to her day job 401k strategy, then she can only make the earnings sharing contribution (Type 2) to the solo 401k strategy and it would be based on her net self-employment income from business that sponsors the solo 401k plan.