Our Cryptocurrency News & Discussion - Reddit Statements

The Main Principles Of #cryptocurrency hashtag on Instagram • Photos and Videos

Each cryptocurrency declares to have a different function and spec. For instance, Ethereum's ether markets itself as gas for the underlying clever contract platform. Gold Coast Money Online is used by banks to assist in transfers between various locations. Bitcoin, which was provided to the public in 2009, stays the most extensively traded and covered cryptocurrency.

Cryptocurrency Trends: Is Bitcoin Mining Profitable in 2022 - HP® Tech Takes

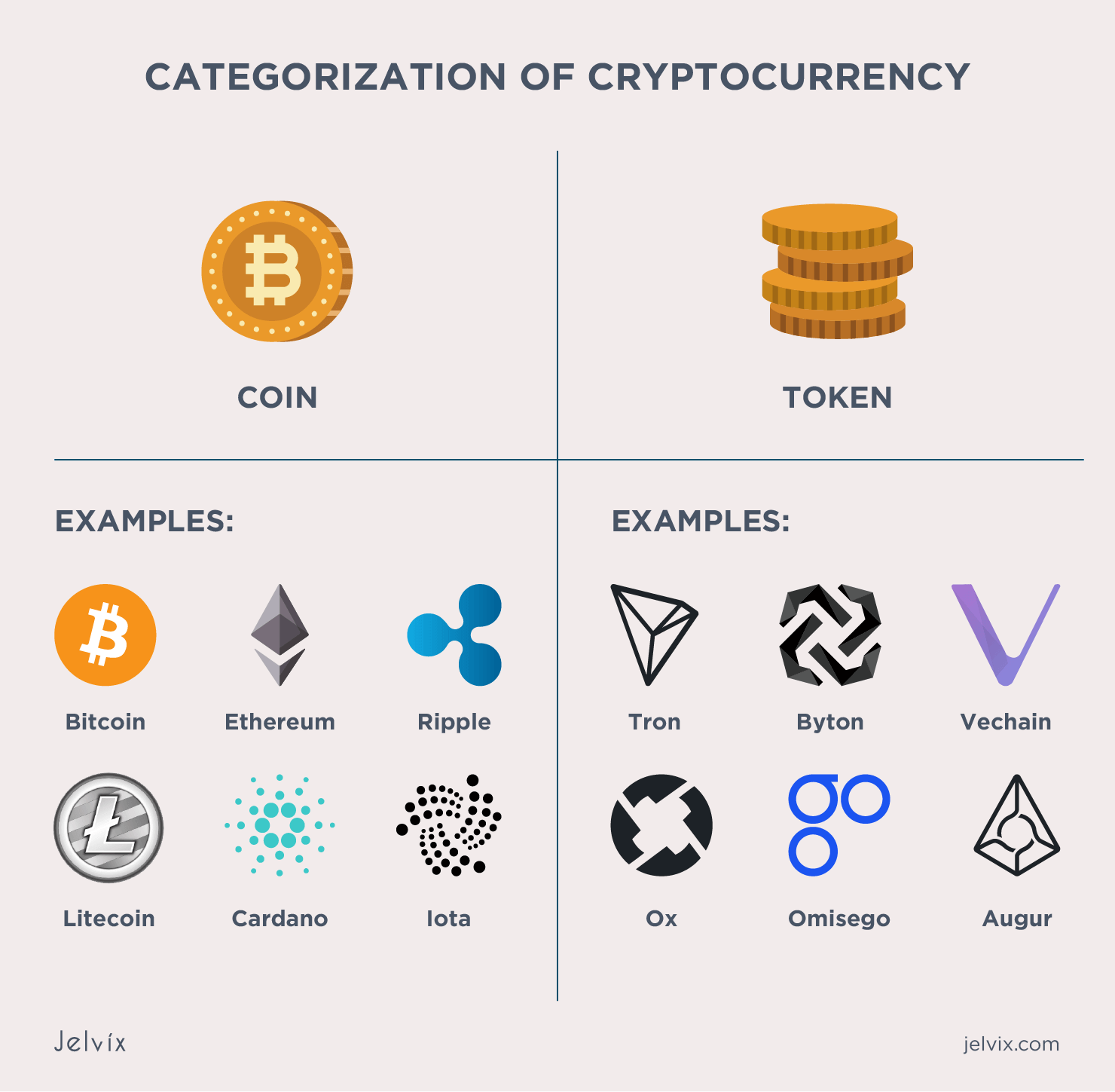

Cryptocurrency Trends: Is Bitcoin Mining Profitable in 2022 - HP® Tech TakesOnly 21 million bitcoins will ever exist. In the wake of Bitcoin's success, lots of other cryptocurrencies, referred to as "altcoins," have been introduced. Some of these are clones or forks of Bitcoin, while others are brand-new currencies that were constructed from scratch. They include Solana, Litecoin, Ethereum, Cardano, and EOS. By November 2021, the aggregate worth of all the cryptocurrencies around had actually reached over $2.

Are Cryptocurrencies Legal? Fiat currencies derive their authority as mediums of transaction from the government or monetary authorities. For example, each dollar expense is backstopped by the Federal Reserve. However cryptocurrencies are not backed by any public or personal entities. For that reason, it has been challenging to make a case for their legal status in different financial jurisdictions throughout the world.

Cryptocurrency Ecommerce: How It Works + FAQ Answers

Cryptocurrency Ecommerce: How It Works + FAQ AnswersUnknown Facts About Cryptocurrency - Latest News, Photos & Videos - WIRED

The legal status of cryptocurrencies has ramifications for their use in daily deals and trading. In June 2019, the Financial Action Job Force (FATF) recommended that wire transfers of cryptocurrencies need to be subject to the requirements of its Travel Guideline, which needs AML compliance. As of December 2021, El Salvador was the only nation worldwide to enable Bitcoin as legal tender for financial deals.

Japan's Payment Provider Act defines Bitcoin as legal residential or commercial property. Cryptocurrency exchanges operating in the nation go through collect information about the customer and information connecting to the wire transfer. China has prohibited cryptocurrency exchanges and mining within its borders. India was reported to be creating a structure for cryptocurrencies in December.

Derivatives and other items that utilize cryptocurrencies will need to qualify as "financial instruments." In June 2021, the European Commission launched the marketplaces in Crypto-Assets (Mi, CA) policy that sets safeguards for regulation and establishes rules for companies or suppliers supplying financial services using cryptocurrencies. Within the United States, the most significant and most advanced financial market on the planet, crypto derivatives such as Bitcoin futures are available on the Chicago Mercantile Exchange.